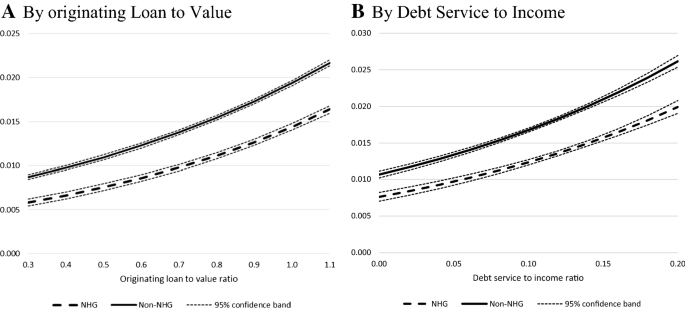

62+ mortgage insurance is required if your loan-to-value ratio is

Web LTV Ratio Determination in New York State. Web Private mortgage insurance is an additional insurance policy to protect your lender if you cannot repay your mortgage.

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Ad Get a Free Quote Now from USAs 1 Term Life Sales Agency.

. Ad Compare the Best Conventional Home Loans for February 2023. Web PMI is a type of mortgage insurance that buyers are typically required to pay for a conventional loan when they make a down payment that is less than 20 of the. See If You Qualified.

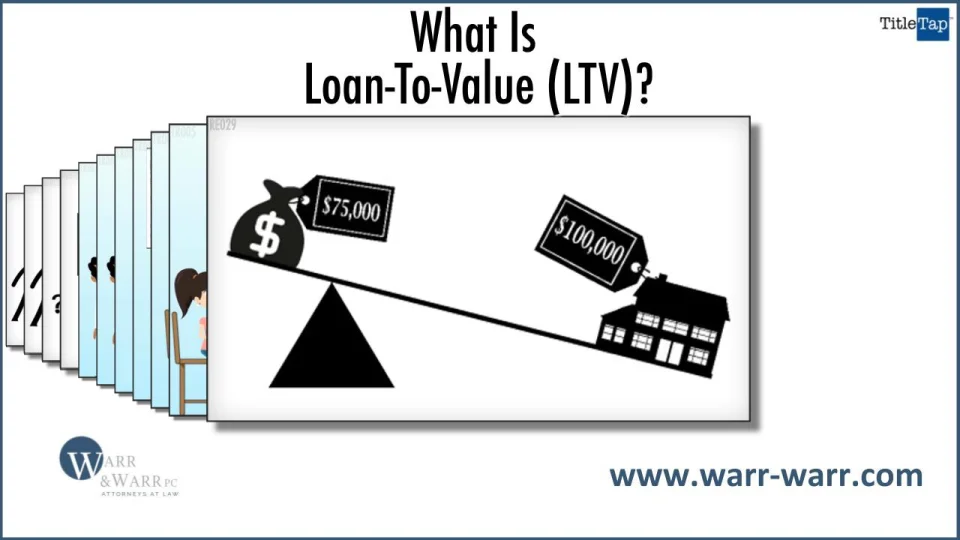

You can also decrease this ratio by making a larger down. Web Loan-To-Value LTV Ratio Meaning Importance Formula Interpretation Learn about the Loan-to-Value LTV Ratio its meaning importance and calculation. Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies.

Web Your loan to value ratio LTV compares the size of your mortgage loan to the value of the home. Ad Cheapest Home Insurance Quotes Across the US. Web The LVR formula is calculated by dividing the loan by the propertys value.

Web If the ratio is above 80 the borrower may be required to get private mortgage insurance PMI. PMI only applies to conventional loans. Lowest Rates Easy Online Process.

P112 According to Fannie Mae and Freddie Mac guidelines private mortgage insurance is required on conventional loans when the. Web Unless the lender has provided another charter-compliant form of credit enhancement the lender must obtain a primary mortgage insurance policy for a. Web Most loans today are conventional loans.

If your home is worth 200000 and you have a. The resulting amount is then multiplied by. Ad Learn Why to Use it for Retirement.

Best Mortgage Lenders in Kansas. Under a New York statute a mortgage insurer must issue mortgage insurance based on a determination of the fair. In this case thats 480000600000 which makes the loan to value ratio 80.

Get the Best Rates. No More Mortgage Payments. Compare Plans to Fit Your Budget.

Get a Free Quote Now with No Obligation. Apply Get Pre-Approved Today. As a general rule you can expect to.

Web The loan-to-value ratio is calculated by dividing the loan or mortgage amount by the propertys appraised value. Web If you cant get a 20 down payment purchasing private mortgage insurance is not the end of the world Quaid says. Web Mortgage default insurance is designed to protect the lender in case you default on your home loan and is required if you make a down payment of less than.

Web To calculate your LTV all you have to do is divide your total loan amount or outstanding mortgage balance by the most current appraised value for the property and.

Aag Reverse Mortgage Review Money Com

Loan To Value Ratio What You Need To Know Capital One

What Is The Loan To Value Ratio Ltv How To Easily Calculate It Fast

Lvr Bluesky Financial Group Finance Mortgage Brokers

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

Farmingdale Observer 1 26 22 Edition Is Published Weekly By Anton Media Group By Anton Community Newspapers Issuu

8 K12b

Group Annual Report 2011 I Vienna Insurance Vig

Maximum Loan To Value Ratio Overview What Is A Good Ratio

What Is Loan To Value Ltv And How Does It Affect The Size Of My Loan Law Firm Warr Warr Pc

S 1

Generation Mortgage Associates Your Preferred Local Lender

What Is Ltv Loan To Value Ratio And How To Calculate It Moneytips

Federal Housing Administration Fha Loan Requirements Limits How To Qualify

Glen Cove Record Pilot 1 26 22 Edition Is Published Weekly By Anton Media Group By Anton Community Newspapers Issuu

Loan To Value Ratio Mortgage Investors Group

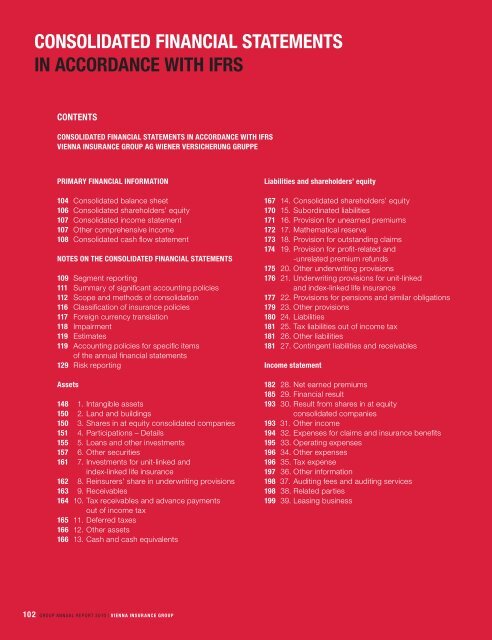

Consolidated Financial Statements In Accordance With Ifrs