11+ Chapter 6 Risk Aversion And Capital Allocation To Risky Assets

For a given expected cash flow portfolios that command greater risk premia must sell at lower prices. 6 Capital Allocation across Risky.

6-2 Allocation to Risky Assets Speculation is the undertaking of a risky investment for its risk premium.

. A process of how businesses divide their financial resources and other sources of capital to different processes people and projects. To turn a gamble into a specula琀椀ve prospect requires an adequate risk premium to compensate risk-averse investors for the risk they bear. CHAPTER 6 RISK AVERSION AND CAPITAL ALLOCATION TO.

Risk-free assets not securities. I Risk-averse investors reject investments that are fair games. Investors will avoid risk unless there is a reward.

Baca Juga

- 21+ abstract sun and moon

- 19+ 2Nd Timothy Chapter 3

- 36+ Chapter 7 Bankruptcy Student Loans

- 36+ The Kite Runner Chapter 22 Summary

- 37+ The Novel'S Extra Remake Chapter 21

- 36+ When Will Chapter 3 Season 2 Start

- 27+ Magic Emperor Chapter 299

- Isekai Yakkyoku Chapter 42

- 11+ quick dra2w

- 18+ Mason Craft And More Jars

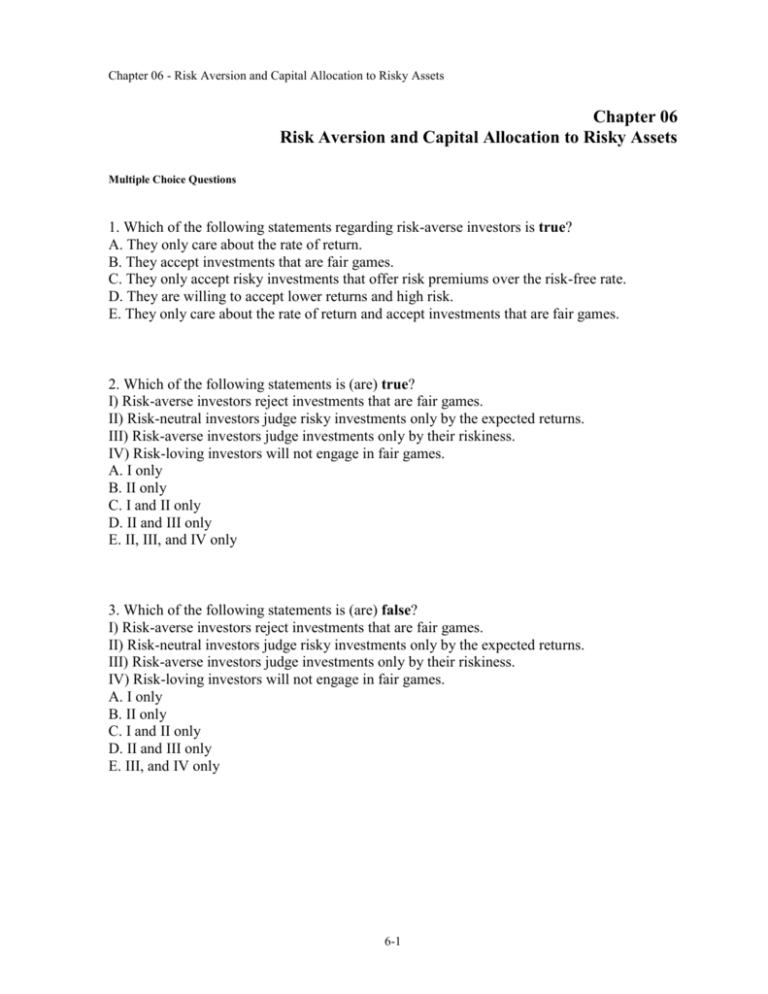

Chapter 06 - Risk Aversion and Capital Allocation to Risky Assets Chapter 06 Risk Aversion and Capital Allocation to Risky Assets. RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS 1. Which of the following statements is are false.

Commensurate gain is the positive risk premium that is expected to be greater than a risk free alternative. This is way more important In doing so we view the. The expected cash flow is.

Considerable risk is sufficient enough to affect the decision. Which of the following. I Risk-averse investors reject investments that are fair games.

05 200000 135000 With a risk premium of 8 over the risk. Chapter 06 - Risk Aversion and Capital Allocation to Risky Assets 6-2 d. View Test Prep - RISK AVERSION AND CAPITAL ALLOCATION TO RISKY ASSETS from FIN 6537 at Florida Atlantic University.

Chapter 06 - Risk Aversion and Capital Allocation to Risky Assets 3. Speculation is taken in. Hence risk aversion and specula琀.

Itdue south one of the most basic investing terms to know and likewise 1 of the almost important. Deciding how much to invest in risky vs. A fair game is a risky prospect that.

II Risk-neutral investors judge risky investments only by the expected returns. III Risk-averse investors judge investments. Asset allocation ways the mix or range of investments you hold in a portfolio.

Overall it is managements goal.

Chapter 6 Capital Allocation To Risky Assets You Can Invest In Options Etfs Congolese Cobalt Studocu

Chap 06 Risk Aversion And Capital Allocation Pdf Risk Aversion Risk Premium

Topic 1 Ch 6 Risk Aversion And Capital Allocation To Risky Assets Ppt Video Online Download

Pdf Chapter One Why Are Financial Intermediaries Special Md Rased Mosarraf Academia Edu

Ppt Chapter 6 Powerpoint Presentation Free Download Id 1389801

Chapter6 Risk Aversion And Capital Allocation 1 Youtube

Ppt Chapter 6 Powerpoint Presentation Free Download Id 1389801

Risk Management And Value Creation In Arabictrader Com

Topic 1 Ch 6 Risk Aversion And Capital Allocation To Risky Assets Ppt Video Online Download

Chapter 06 Risk Aversion And Capital Allocation To Risky Assets

Chapter 6 Risk Aversion And Capital Allocation To Risky Assets Pdf Free Download

Pdf Chapter 6 Risk Aversion And Capital Allocation To Risky Assets Multiple Choice Questions Aakriti Arora Academia Edu

Chapter 6 Risk Aversion And Capital Allocation To Risky Assets Pdf Free Download

Risk Aversion And Capital Allocation To Risky Assets Ppt Video Online Download

305

Stocks Part Xxvii Why I Don T Like Dollar Cost Averaging Jlcollinsnh

Risk Premium Wikiwand